Judy Sheindlin Net Worth: How Much is Judge Judy Worth? is a biographical and financial profile that explores the wealth and financial standing of American television personality and retired judge Judith Sheindlin. It investigates the sources of her income, assets, investments, and overall financial status. Understanding an individual's net worth provides insights into their financial success and can serve as a reference point for personal financial planning and wealth management.

Knowing the net worth of public figures like Judge Judy can be beneficial for several reasons. It allows us to assess their financial acumen, gain insights into their investment strategies, and understand the correlation between their career success and financial well-being. Historically, the concept of net worth has evolved from being a measure of an individual's wealth to a comprehensive indicator of their financial health and overall economic status.

This article delves into the details of Judge Judy's net worth, examining her earnings from her various endeavors, including her long-running courtroom show, endorsements, investments, and other sources of income. It provides a comprehensive analysis of her financial journey and offers valuable insights into the financial aspects of her life and career.

Judy Sheindlin Net Worth

Understanding Judy Sheindlin's net worth entails examining key aspects that contribute to her overall financial standing. These aspects provide insights into her sources of wealth, financial strategies, and overall economic well-being.

- Earnings: Income from TV shows, endorsements, investments

- Assets: Real estate, vehicles, collectibles

- Investments: Stocks, bonds, mutual funds

- Debt: Mortgages, loans, outstanding payments

- Expenses: Lifestyle costs, taxes, charitable contributions

- Tax Strategies: Minimizing tax liability, maximizing deductions

- Financial Planning: Retirement planning, estate planning

- Net Worth Calculation: Assets minus Liabilities

Analyzing these aspects provides a comprehensive view of Judge Judy's financial situation. Her earnings from her successful TV show have significantly contributed to her wealth. Additionally, her investments and assets have played a role in growing her net worth over time. Understanding the interplay between these key aspects helps us appreciate the complexity of managing and maintaining financial well-being.

Earnings

Earnings from various sources, including TV shows, endorsements, and investments, play a pivotal role in shaping Judy Sheindlin's net worth. As the long-running star and creator of the popular courtroom show "Judge Judy," Sheindlin has amassed substantial wealth from her television career. The show's success has led to syndication deals, international distribution, and lucrative contracts for Sheindlin, contributing significantly to her overall earnings.

Beyond television, Sheindlin's brand and reputation have earned her lucrative endorsement deals with various companies. Her credibility as a legal expert and strong public persona have made her an attractive partner for brands seeking to align themselves with her values and image. These endorsements further supplement her income streams.

Additionally, Sheindlin has made wise investments over the years, diversifying her portfolio across stocks, bonds, and real estate. Her investment strategy has been instrumental in growing her wealth and securing her financial future. By leveraging her earnings from TV shows and endorsements, Sheindlin has been able to invest in various assets, further increasing her net worth.

Understanding the connection between Judy Sheindlin's earnings and net worth highlights the importance of multiple income streams and strategic investments in building and maintaining wealth. Her diverse earnings portfolio and sound investment decisions have been key factors in her financial success, showcasing the practical applications of leveraging various income sources and making informed financial choices.

Assets

Assets, encompassing real estate, vehicles, and collectibles, play a vital role in determining Judy Sheindlin's net worth. These tangible and intangible possessions contribute significantly to her overall financial standing and reflect her investment strategies and lifestyle choices.

- Real Estate: Sheindlin owns several residential and commercial properties, including her primary residence in Florida and investment properties in various locations. Real estate investments have traditionally been a stable and lucrative asset class, providing both rental income and potential appreciation in value.

- Vehicles: Sheindlin has a collection of luxury and vintage cars. While vehicles can depreciate in value over time, certain classic and collectible cars can appreciate in value, becoming valuable assets.

- Collectibles: Sheindlin is known for her extensive collection of art, jewelry, and other collectibles. Collectibles can be valuable investments if they are rare, unique, or in high demand, potentially appreciating significantly over time.

Judy Sheindlin's diverse asset portfolio, spanning real estate, vehicles, and collectibles, reflects her financial savvy and investment strategies. These assets, along with her earnings and investments, contribute to her substantial net worth, providing financial security and enhancing her overall economic well-being.

Investments

Understanding the role of investments in Judy Sheindlin's net worth requires examining her financial strategies and investment portfolio. Sheindlin has invested in various asset classes, including stocks, bonds, and mutual funds, to diversify her wealth and generate passive income.

- Stock Investments: Sheindlin has invested in a range of individual stocks, representing ownership shares in publicly traded companies. Stocks offer the potential for capital appreciation and dividend income, but also carry varying levels of risk.

- Bond Investments: Sheindlin's bond portfolio likely consists of government and corporate bonds, which provide fixed income payments over a specified period. Bonds generally offer lower returns than stocks but are considered less risky.

- Mutual Fund Investments: Sheindlin may have invested in mutual funds, which are professionally managed baskets of stocks and bonds. Mutual funds offer diversification and the potential for growth, but their performance depends on the underlying investments.

Judy Sheindlin's investment strategy, encompassing stocks, bonds, and mutual funds, reflects her risk tolerance, investment goals, and financial acumen. These investments contribute significantly to her overall net worth and provide a steady stream of passive income, further enhancing her financial security.

Debt

Debt, encompassing mortgages, loans, and outstanding payments, plays a crucial role in understanding Judy Sheindlin's net worth. Debt represents financial obligations that must be repaid, and managing debt effectively can significantly impact an individual's overall financial well-being.

Debt can affect net worth in several ways. High levels of debt can reduce an individual's net worth by decreasing their equity and increasing their financial obligations. Conversely, manageable debt levels can contribute to net worth growth if the borrowed funds are used for investments that generate returns exceeding the cost of debt. Sheindlin's financial strategy likely involves balancing debt utilization with income and asset growth to optimize her net worth.

Real-life examples of debt within the context of Judy Sheindlin's net worth could include mortgages on her residential and investment properties. Mortgages represent long-term debt obligations, but they can also be considered investments if the properties appreciate in value over time. Additionally, Sheindlin may have utilized loans or lines of credit to finance certain investments or business ventures, further impacting her debt profile.

Understanding the interplay between debt and net worth is crucial for financial planning and management. Individuals should carefully consider the types and amounts of debt they take on, ensuring that their debt obligations are aligned with their financial goals and risk tolerance. By managing debt effectively, individuals can maximize their net worth and secure their financial future.

Expenses

Understanding the expenses associated with Judy Sheindlin's lifestyle, tax obligations, and charitable contributions is crucial for assessing her overall net worth. These expenses impact her financial standing and provide insights into her spending habits, financial responsibilities, and philanthropic endeavors.

- Lifestyle Costs: Sheindlin's luxurious lifestyle, including expenses such as travel, dining, entertainment, and personal care, affects her net worth. Her spending habits and consumption choices influence the amount of disposable income available for savings and investments.

- Taxes: Sheindlin, like all high-income individuals, is subject to federal and state income taxes, as well as property taxes on her real estate holdings. Tax obligations can significantly reduce her net worth and impact her financial planning.

- Charitable Contributions: Sheindlin is known for her philanthropic efforts and has made substantial donations to various charities and organizations. These contributions, while reducing her net worth, reflect her commitment to giving back and supporting causes she cares about.

- Estate Planning: Sheindlin's net worth is also influenced by her estate planning strategies. The allocation of her assets through wills and trusts can minimize estate taxes and ensure her wealth is distributed according to her wishes.

These expenses and financial considerations are integral to understanding Judy Sheindlin's net worth. Her lifestyle choices, tax liabilities, and philanthropic activities shape her financial landscape, highlighting the importance of balancing personal expenses, financial responsibilities, and charitable giving in wealth management.

Tax Strategies

The connection between "Tax Strategies: Minimizing tax liability, maximizing deductions" and "Judy Sheindlin Net Worth How Much Is Sheindlin" lies in the impact that tax strategies have on an individual's overall financial standing. Tax strategies are crucial for optimizing net worth by reducing tax liabilities and increasing disposable income.

Effective tax strategies involve utilizing tax deductions, credits, and exemptions to minimize the amount of taxable income. By reducing taxable income, individuals can lower their tax liability and retain more of their earnings. In the case of Judy Sheindlin, her tax strategies have played a significant role in maximizing her net worth.

Real-life examples of tax strategies employed by Sheindlin could include maximizing charitable contributions, utilizing retirement accounts, and claiming eligible business expenses. These strategies have allowed her to minimize her tax liability and increase her net worth over time. Understanding the practical applications of tax strategies is essential for individuals seeking to optimize their financial well-being.

In summary, the connection between "Tax Strategies: Minimizing tax liability, maximizing deductions" and "Judy Sheindlin Net Worth How Much Is Sheindlin" highlights the importance of effective tax planning in wealth management. By implementing sound tax strategies, individuals can reduce their tax burdens, increase their disposable income, and ultimately enhance their overall net worth.

Financial Planning

The connection between "Financial Planning: Retirement planning, estate planning" and "Judy Sheindlin Net Worth How Much Is Sheindlin" lies in the crucial role that financial planning plays in safeguarding and managing wealth. Retirement planning ensures financial security during the post-employment years, while estate planning ensures the orderly distribution of assets after an individual's passing. These aspects are critical for preserving and growing net worth over time.

For Judy Sheindlin, effective financial planning has been instrumental in her journey toward accumulating and maintaining her substantial net worth. She has likely implemented strategies such as investing in retirement accounts, maximizing tax-advantaged savings, and diversifying her investment portfolio to secure her financial future. Estate planning measures, such as wills and trusts, help ensure that her assets are distributed according to her wishes and minimize the impact of estate taxes.

Real-life examples of financial planning within the context of Judy Sheindlin's net worth could include her contributions to 401(k) and IRA accounts throughout her career. By taking advantage of these tax-deferred retirement savings vehicles, she has set aside a significant portion of her income for future financial stability. Additionally, her estate plan likely involves the establishment of trusts to manage her assets and minimize estate taxes, ensuring that her wealth is preserved for her intended beneficiaries.

Understanding the practical applications of financial planning is essential for individuals seeking to optimize their wealth management strategies. By implementing sound financial plans that incorporate retirement and estate planning, individuals can safeguard their financial well-being, protect their assets, and ensure the continuity of their wealth for future generations.

Net Worth Calculation

The calculation of net worth, as defined by "Assets minus Liabilities," is a crucial aspect of understanding "Judy Sheindlin Net Worth How Much Is Sheindlin." It provides a comprehensive overview of an individual's financial status by taking into account both their assets and debts, offering valuable insights into their overall wealth and financial well-being.

- Assets: Assets encompass all resources and possessions owned by an individual, such as cash, real estate, investments, and personal property. In the case of Judy Sheindlin, her assets likely include her primary residence, vacation homes, investment properties, and various financial holdings.

- Liabilities: Liabilities represent debts and obligations owed by an individual, including mortgages, loans, credit card balances, and unpaid taxes. Sheindlin's liabilities may include any outstanding mortgages on her properties, personal loans, or business debts.

- Net Worth: Net worth is calculated by subtracting total liabilities from total assets. A positive net worth indicates that an individual's assets exceed their debts, while a negative net worth indicates that their debts exceed their assets. Sheindlin's net worth is a reflection of her accumulated wealth and financial success.

- Implications: Net worth calculation plays a significant role in financial planning and decision-making. A high net worth can provide financial security, access to credit, and investment opportunities. It can also impact estate planning and tax strategies. Understanding her net worth allows Sheindlin to make informed choices about her financial future.

By examining the various components of "Net Worth Calculation: Assets minus Liabilities," we gain a deeper understanding of Judy Sheindlin's overall financial standing. Her net worth is a testament to her career success, wise investments, and effective financial management, highlighting the importance of asset accumulation and responsible debt management in building and maintaining personal wealth.

In conclusion, our exploration of "Judy Sheindlin Net Worth How Much Is Sheindlin" has illuminated several key ideas and findings. Firstly, Sheindlin's substantial net worth is a testament to her successful career as a television personality, astute investments, and prudent financial strategies. Secondly, her financial journey underscores the importance of multiple income streams, wise asset allocation, and effective debt management in building and maintaining personal wealth. Thirdly, understanding the various components of net worth, including assets, liabilities, and tax strategies, is crucial for informed financial planning and decision-making.

These insights offer valuable lessons for individuals seeking to optimize their financial well-being. Sheindlin's example demonstrates the power of hard work, smart investments, and responsible financial management in achieving financial success. As we navigate our own financial journeys, we can draw inspiration from her strategies and apply them to our unique circumstances. By embracing a holistic approach to wealth management, we can work towards securing our financial futures and building a legacy that reflects our values and aspirations.

Christopher Harvest: Unveiling The Man Behind The Charisma

Uncover Scott Mcgillivray's Net Worth, Wiki, Age, Weight, And More

Doja Cat's New Boyfriend: Everything We Know About Their Relationship In 2024

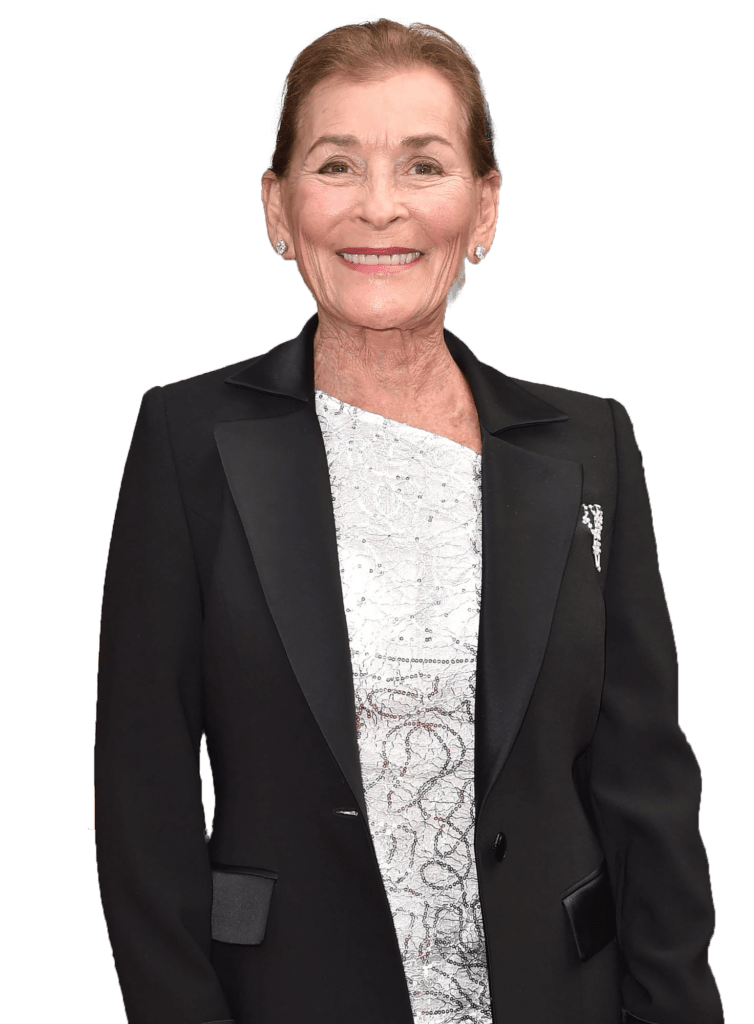

Who is Judge Judy? Judge Judy's Net Worth

Judge Judy Sheindlin Age, Bio, Birthday, Family, Net Worth National

Judy Sheindlin Bio, family, net worth Celebrities InfoSeeMedia

ncG1vNJzZmidmaO5r3rSbGWuq12ssrTAjGtlmqWRr7yvrdasZZynnWS3trDYZqqhnZmjsa21zWalnqxdrLyzwMdmn6ivXaLCpLSMoqpmq5iatq%2Bwy6KlZ6Ckork%3D